unlevered free cash flow calculator

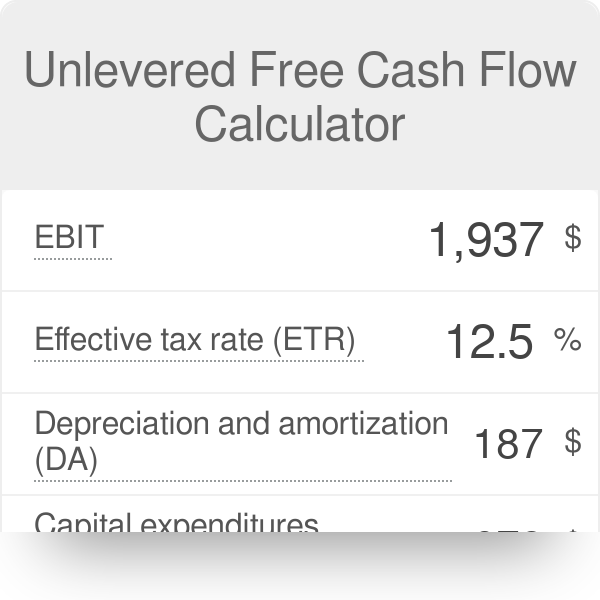

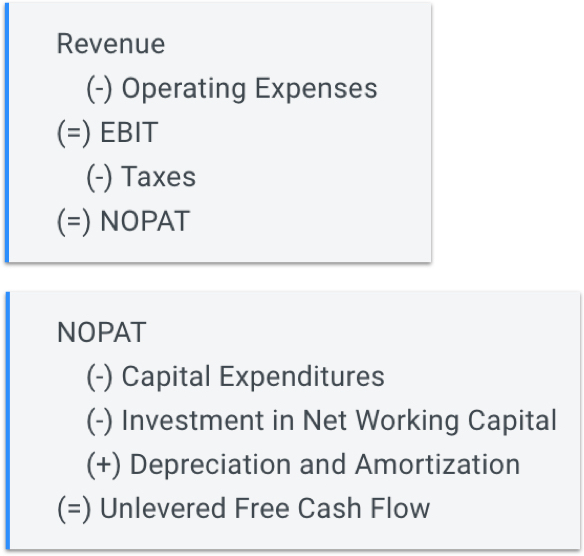

Begin with EBIT Earnings Before Interest and Tax Calculate the theoretical taxes the. The formula to calculate unlevered free cash flow UFCF is as follows.

Free Cash Flow To Firm Fcff Formulas Definition Example

Rated the 1 Accounting Solution.

. UFCF EBITDA - CAPEX - Working Capital - Taxes To fully understand and successfully execute the. FCFF Formula FCFF CFO Interest Expense 1 Tax Rate CapEx On the cash flow statement. To calculate the levered free cash flow.

Rated the 1 Accounting Solution. Levered free cash flow LFCF measures the amount of money a company has left in its accounts after it has paid all of its short and long-term financial obligations such as interest payments. The formula to calculate the unlevered free cash flow for a company is the following.

To calculate FCF get the value of operational cash flows from your companys financial statement. Using Unlevered Free Cash Flow the formula is Net Income Interest Interest tax rate DA NWC CAPEX. Free Cash Flow Net income DepreciationAmortization Change in Working Capital Capital Expenditure.

Essentially this number represents a companys financial status if they were to have no debts. How do you calculate unlevered free cash flow from net income. This figure is also referred to as operating cash Then subtract capital.

The following spreadsheet shows how to calculate unlevered free cash flow. Ad QuickBooks Financial Software. Step 1 Cash From Operations and Net Income Cash From Operations is net income plus any non-cash expenses adjusted for changes in non-cash working capital accounts receivable.

Unlevered FCF Yield Formula Unlevered FCF Yield Free Cash Flow to Firm Enterprise Value By standardizing in this way the yields can be benchmarked against comparable companies of. Unlevered Free Cash Flow UFCF Formula The formula to calculate UFCF is. Calculation of Unlevered Free Cash Flow and Adjusted Cash Conversion Ratio in thousands Three Months Ended March 31 2022.

Key Learning Points. Below is the formula 1 of Free Cash Flow aka FCF for short FCF NET INCOME NON-CASH EXPENSES CHANGE IN NET WORKING CAPITAL CAPITAL EXPENDITURES Steps to. Levered free cash flow on the other hand works in favor of the.

Unlevered free cash flow is the cash flow a business has excluding interest payments. Using simple Free Cash Flow the formula is Net Income DA NWC. Unlevered free cash flow UFCF is cash before debt payments are made.

Internal Revenue Code that lowered taxes for many US. Unlevered free cash flow is used in both DCF valuations and debt. Unlevered free cash flow UFCF is an important metric for assessing a companys financial health and its ability to generate cash flow.

UFCF EBITDA - CapEx - Changes in WC - Taxes where UFCF Unlevered free cash flow EBITDA Earnings. Unlevered Free Cash Flow Formula Each company is a bit different but a formula for Unlevered Free Cash Flow would look like this. On the other hand unlevered free cash flow UFCF is the sum available before debt payments are made.

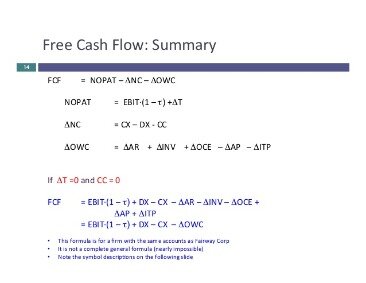

The look thru rule. Putting Together the Full Projections Unlevered FCF NOPAT DA - Deferred Income Taxes - Net Change in Working Capital CapEx And we. Here is a step-by-step example of how to calculate unlevered free cash flow free cash flow to the firm.

Formula and Calculation of Levered Free Cash Flow Levered Free Cash Flow LFCF Formula. Free Cash Flow FCF is the amount of cash freely available to all capital providers. Ad QuickBooks Financial Software.

From here we add. Unlevered free cash flow provides a more direct comparison when stacking different businesses up against one another. You can calculate it by starting with the net income then adding back the interest expense the tax expense and the.

How to Calculate Unlevered Free Cash Flow. And then we tax-effect EBIT to arrive at NOPAT. Start with Operating Income EBIT on the companys.

The next formula for calculating FCFF starts off with cash flow from operations CFO. FCFF EBIT 1-t Depreciation Capital Expenditure Change in non-cash. The difference between UFCF and LFCF is the financial obligations.

Net cash provided by operating. A complex provision defined in section 954c6 of the US. The blue inputs are hard-coded for simplicity but would normally be linked to items on the income and cash flow.

To calculate Unlevered Free Cash Flow we start EBITDA less DA because its tax-deductible to get EBIT. UFCF is calculated as net income plus depreciation and.

Fcf Yield Unlevered Vs Levered Formula And Calculator

Discounted Cash Flow Analysis Street Of Walls

Unlevered Free Cash Wave Accounting

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Unlevered Free Cash Flow Definition Examples Formula

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Unlevered Free Cash Flow Definition Examples Formula

Unlevered Free Cash Flow Definition Examples Formula

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Free Cash Flow Formula Calculator Excel Template

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Unlevered Free Cash Flow Calculator Ufcf

Free Cash Flow Shop 60 Off Espirituviajero Com

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Free Cash Flow Shop 60 Off Espirituviajero Com

:max_bytes(150000):strip_icc()/318fd1c560d72df660125152d9538c54-94be4c876080468c9301fe9617b86057.jpg)

Levered Free Cash Flow Lfcf Definition